EU Taxonomy KPI Report

| Turnover | CAPEXt | OPEXt | |||||

| bill. CZK | % | bill. CZK | % | bill. CZK | % | ||

| A | ELIGIBLE ACTIVITIES | 106.9 | 31.4% | 29.0 | 73.1% | 9.2 | 63.9% |

| A.1 | Taxonomy-aligned activities | 92.5 | 27.1% | 26.7 | 67.3% | 6.6 | 45.9% |

| A.1 / A | Ratio of Taxonomy-aligned to Taxonomy-eligible activities* | 86% | 92% | 72% | |||

| A.1 | Taxonomy-aligned activities | 92.5 | 27.1% | 26.7 | 67.3% | 6.6 | 45.9% |

| A.1 | Taxonomy-aligned | 63.8 | 18.7% | 22.0 | 55.4% | 2.1 | 14.8% |

| A.1.2 | Taxonomy-aligned transitional (nuclear. gas) | 28.6 | 8.4% | 4.7 | 11.9% | 4.5 | 31.1% |

| A.2 | Eligible. not taxonomy-aligned activities | 14.4 | 4.2% | 2.3 | 5.8% | 2.6 | 17.9% |

| B | NONELIGIBLE ACTIVITIES | 233.7 | 68.6% | 10.7 | 26.9% | 5.2 | 36.1% |

| B.1 | Noneligible neutral activities | 191.8 | 56.3% | 5.6 | 14.0% | 0.6 | 4.2% |

| B.2 | Noneligible emission activities | 41.9 | 12.3% | 5.1 | 12.9% | 4.6 | 31.9% |

| A+B | TOTAL | 340.6 | 100% | 39.6 | 100% | 14.5 | 100.0% |

CEZ Group reports key indicators of the EU taxonomy in accordance with EU Regulation 2020/852 the so-called Taxonomy Regulation and related delegated acts. For fiscal year 2023, we report eligibility and alignment of our economic activities in relation to all six environmental objectives. CEZ Group business activities in the energy sector and energy services are primarily focused on a substantial contribution to mitigation, and CEZ Group does not carry out significant economic activities aimed at adaptation (CCA).

In accordance with the requirements, CEZ Group also reports identified economic activities in relation to the other four environmental objectives for which the classification of activities was created in 2023: Water Protection (WTR), Pollution prevention and control (PPC), Transition to circular economy (CE), and Biodiversity and Ecosystem Protection (BIO).

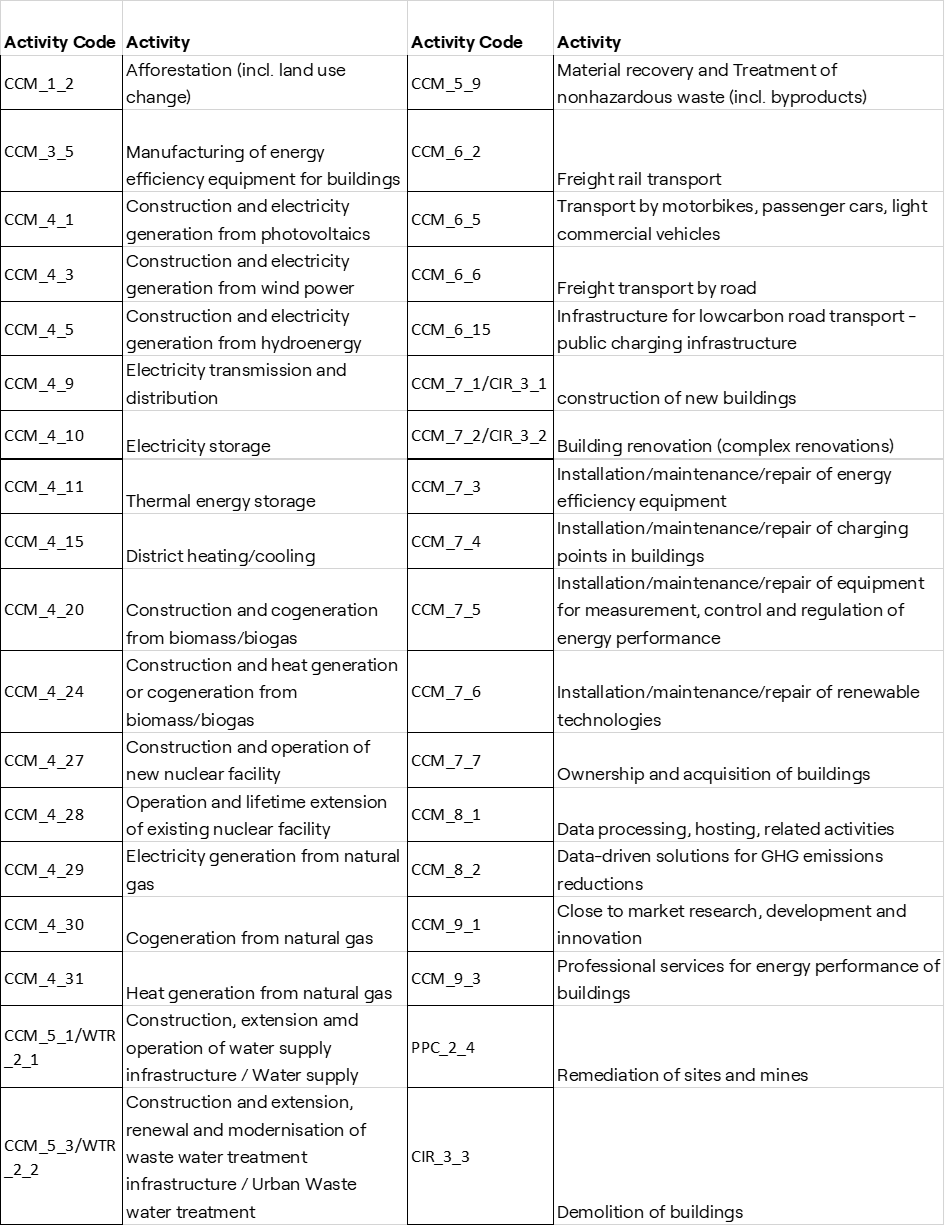

When preparing the report, CEZ Group assessed the relevant economic activities according to the classification of activities and their significance to operating income or investments. Based on this assessment, CEZ Group implemented the following eligible activities in 2023.

Each activity included in our report (material or nonmaterial) has been assessed against EU taxonomy technical screening criteria. That includes new activities eligible since 2023. CEZ Group performed alignment screening and discloses both eligibility and alignment for new activities. CEZ Group thus comply with disclosure requirement one year prior to legal obligation.

Technical screening criteria consist of Substantial Contribution Criteria for one environmental objective (mainly climate change mitigation objective) and Do No Significant Harm criteria for other five environmental objectives. The alignment is assessed on the level of a single economic activity or projects of a given company. The climate risks and social safeguards have group-level importance across activities and are assessed on CEZ Group level.

Activities in CEZ Group disclosures are grouped into 4 categories:

- Renewable energy

- Transitional energy – nuclear and gas

- Infrastructure activities – Electricity and heat distribution

- Energy services and other eligible activities

The DNSH criterion for adaptation to physical climate risks is broadly applicable to all group activities and is significant on group-level. In 2022, we assessed the vulnerability of our significant sites in variant scenarios in line with the Financial Stability Board's recommendations for climate risk management (TCFD). More TCFD Report 2022.

In 2023, CEZ Group conducted a detailed climate risk assessment for more than 1000 individual locations across CEZ Group's sectors and economic activities. The assessment was carried out by CEZ Group's ESG Reporting Department using a regional climate risk model and scoring of all risks defined in Annex A to Climate Change Adaptation against the RCP4.5 scenario. In addition, CEZ Group assessed the impact of climate change in variant scenarios on the production of photovoltaic and wind power plants in existing locations and at installation companies within the CEZ Group. This effect on the average reduction in production in the assessed horizon 2023-2040 is considered negligible or low in terms of business impact.

Based on these assessments, CEZ Group does not report any high-risk site under direct management control in terms of a detailed assessment according to climate scenario RCP4.5. Whenever an increased risk of exposure to a specific manifestation of climate change was identified in selected locations we assessed the risk management approach and materiality of the impact on the given economic activity. In most of these affected significant locations, operational risk management takes place, which takes into account natural hazards and climate development. The most of impacted subsidiaries have set up a process for mitigating the known risk, or have directly implemented partial adaptation activities to mitigate significant risks (net risk) in recent years. In the case of nuclear power plants, a robust assessment and implementation of risk reduction measures is carried out according to the requirements of the regulator and international safety standards (detailed assessment is available in activity CCM_4_28 assessment in CEZ Group Sustainability Report 2023).

CEZ Group's risk management also includes sustainability and physical climate-related risks in several subcategories. The negative impacts of extreme temperatures, droughts and floods are part of the managed operational risks. Long-term changes in average temperatures have an impact on the future market price of energy and are part of managed financial risks. The variability and change of wind weather further affect estimates and plans within the managed volumetric risks related to electricity generation from wind farms. All these risks are monitored, evaluated and regularly reviewed. 97% of the total production capacity has a certified EMS system (ISO 14001), which also includes the management of environmental risks, including climate risks.

CEZ Group ensures full compliance with the minimum social safeguards and conducts its business in accordance with human rights and ethical principles. The Group use the fundamental international conventions (ILO, UN) and fully complies with international conventions and declarations for human and labor rights and takes them into full consideration when developing ethical commitments and rules.

CEZ Group has established a Code of Ethics for Employees and a Code of Ethics for Suppliers. The Code of Ethics for Employees is binding on all employees and its knowledge is verified and enforced through regular mandatory employee training. The obligation to comply with the Supplier Code of Ethics is enforced contractually through the Commitment to Ethical Conduct and the General Terms and Conditions of ČEZ a.s. Compliance with the rules and obligations arising from the Code of Ethics is monitored through internal audits and compliance checks. The ultimate remedy for a breach of the Supplier Code of Conduct is termination of the business relationship with the supplier concerned.

CEZ Group has a compliance management system (CMS) in place that is designed in accordance with legislative requirements and international compliance standards, in particular ISO 37001:2016 Anti-Corruption Management System and ISO 37301:2021 Compliance Management System. CEZ Group's Compliance Management System undergoes regular external assessments and includes all necessary elements of prevention, detection, and response, which are generally considered to be an essential part of compliance programs.

The Group is not in any open controversy in relation to social and human rights. We conduct our business in accordance with human rights and ethical principles. In line with good practice presented by Sustainable Finance platform (advisory body of European Commission) we complement our assessment with following independent sources:

|

CEZ Group has not received any complaint and does not have an open case with the National Contact Point for the OECD Guidelines for Multinational Enterprises (Ministry of Industry and Trade of the Czech Republic). |

No complaint |

|

CEZ Group has not been accused of human rights violations by the Business and Human Rights Resource Centre (BHRRR), nor has it received a request to comment on an open case with controversy. |

No accusation. No request to comment |

|

CEZ Group is not and has not been convicted of human and labor rights violations during reported year. (See GRI 205-1, 206-1, 406-1, 407-1, 408-1, 409-1, 413-2, 414-2, 2-27). |

No breach of law |

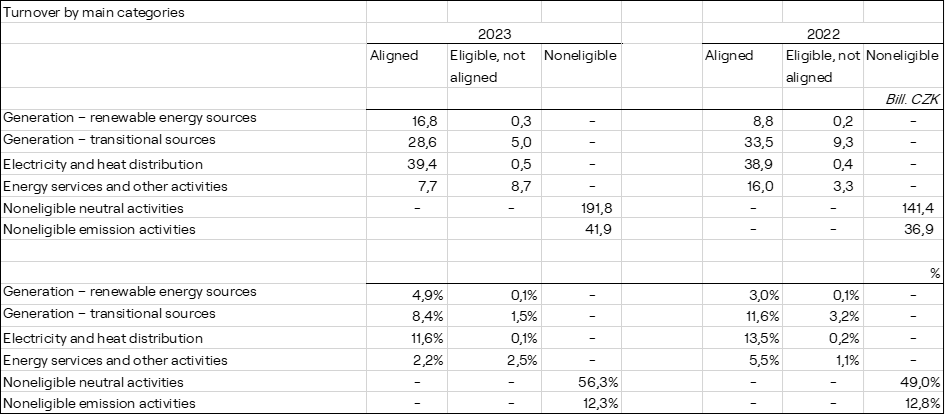

The share of CEZ Group's revenues in accordance with the EU taxonomy is 27.15% (-6.5 p.p.). These are mainly revenues from electricity distribution and production from nuclear energy. Other important activities include the construction and operation of photovoltaic power plants, the installation of energy-saving equipment, the installation of photovoltaics and heat pumps in buildings, hydropower and heat distribution and supply.

Activities that are eligible but do not meet all the requirements under the taxonomy include, in particular, the area of natural gas energy production, where existing installations do not meet the defined criteria. Furthermore, the installation of technologies and energy-efficient equipment, especially in the German market, where the choice of specific devices is primarily subject to the client's choice and where compliance with the taxonomy criteria could not be demonstrated in 2023.

The main factors influencing CEZ Group's performance and operating revenues in 2023 are listed in the 2023 Annual Financial Report. The dominant influence on the results of the KPIs according to the taxonomy was the continuing significant increase in sales in the sales segment, related to the sale of electricity and gas to customers. This reduced the impact of other segments and activities in the taxonomic indicator of operating revenue. Revenues from electricity distribution remained at the level of 2022. Revenues from the construction and operation of photovoltaic and wind power plants increased, while revenues from production at CEZ Group's nuclear power plants declined due to levy on generation revenues above price caps.

Full KPI disclosure template with activity-level information is available in CEZ Group Sustainability Report 2023.

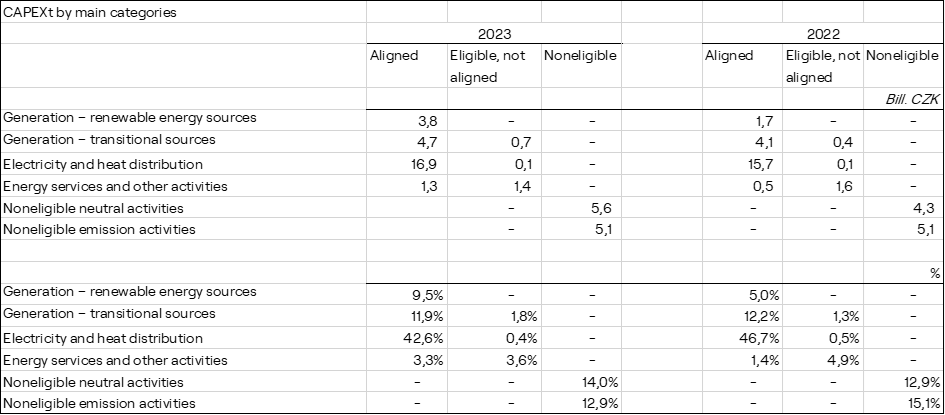

The structure of CEZ Group's sustainable investments is focused primarily on the modernization and renewal of the electricity network and distribution (CZK +2 billion). Investments in transitional sustainable activities included mainly investments in the operation of nuclear facilities in existing locations, investments in the construction of photovoltaic power plants (CZK +1.5 billion) and preparatory investments in the transformation of the coal-fired site in Mělník into steam-gas power and heat sources.

In line with CEZ Group's decarbonization ambitions, the current investment plan for 2024–2028 is focused on areas in which we expect to achieve 82% taxonomy compliance (CAPEXt). The most important categories are investments in renewable energy sources and investments in the distribution system. Of which, 21% of the investments will be directed to transitional sustainable activities of nuclear and gas energy projects. ČEZ, a.s., is preparing new gas projects and strives for full compliance with the technical criteria of the EU taxonomy. These projects are now in the preparation phases and are being prepared to replace a large part of the planned decommissioned coal generation capacity. These projects are hydrogen-ready and will make it possible to significantly reduce the intensity of greenhouse gas emissions compared to current sources. At the same time, CEZ Group plan to spend only about 3% of our investments on activities that are related to the category of noneligible – emission activities (coal related).

Full KPI disclosure template with activity-level information is available in CEZ Group Sustainability Report 2023.

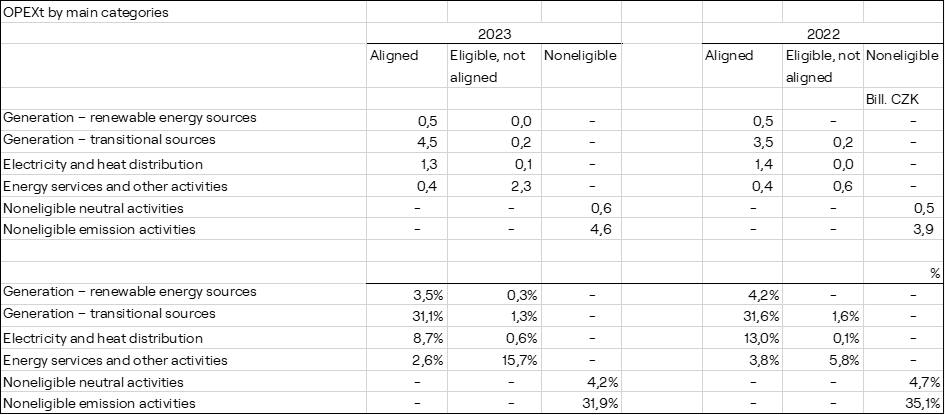

Taxonomy-aligned activities have share of 45.9% KPI OPEXt. The result is predominantly based on maintenance and repair expenses in aligned nuclear facilities and electricity distribution infrastructure.

In the case of eligible expenditure, due to expansion of classified activities in 2023, new demolition activity is reported. Demolition works cover the demolition of coal-energy production sites, in accordance with their transition plans. This activity is associated with a significant amount of operating expenses (10.1%), and CEZ Group plans to carry out this activity in accordance with the circular criteria according to the taxonomy.

Full KPI disclosure template with activity-level information is available in CEZ Group Sustainability Report 2023

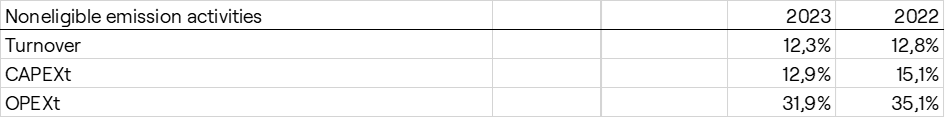

The noneligible category includes both activities with environmental impact and activities without any environmental impacts, thus outside the scope of taxonomy. For that reason, we separate noneligible activities in two categories – neutral and emission activities.

The largest share of noneligible revenues is represented by neutral activities. Those activities themselves have low or no impact on environment and are outside of the scope of Taxonomy in principle. Those activities are trading and selling commodities (electricity, gas), distribution of natural gas, manufacturing of components and servicing for energy technologies, ICT and telecommunication services, facility management and other services.

As noneligible neutral activity we assess the operation of research nuclear reactors of CV Řež, s.r.o. The reactors are not used to produce electrical or thermal energy and are part of the Czech International Centre of Research Reactors. The reactors are licensed for operation by State Office for Nuclear safety.

Category of Noneligible emission activities include coal mining activities and generation of electricity and heat from coal sources. Emission activities are activities considered as noneligible with direct impact on environment.

NUTNOST UPRAVIT DESETINNÉ ČÁSKY V TABULCE ZA ČÍSLA!!!

Capex for coal energy is oriented towards modernization, maintenance and ecologization of their operation. Those investments are necessary for energy security and adequate heat supply until low-emission and zero-emission sources will be in operation. Capex in mining activities is oriented towards retrofitting and modernization of mining and processing technology in line with development plans for current mining locations. OPEX in noneligible activities is connected to repair and maintenance of coal power plants and maintenance of mining equipment. The share of noneligible emission activities will gradually decline in line with planned coal phase-out in line with CEZ Group decarbonization commitments and goals validated by SBTi.