Expanding strategic partnership: EIB provides further EUR 50 million to the Czech fund Inven Capital to support investments into climate-friendly start-ups

• The European Investment Bank (EIB) has committed another EUR 50 million to co-investments with the Czech Inven Capital fund, expanding their strategic partnership that started six years ago. • EIB’s co-investment aims to leverage Inven’s market access and expertise to deploy EIB funding in smaller innovative companies and support tech solutions that can contribute to a reduction in CO2 emissions. • The project will ease financial constraints for SMEs and Mid-Caps and contribute to EIB´s research, innovation, digital, climate action and environmental sustainability policy objectives. • The total assets value under management of Inven capital has now reached over EUR 500 million.

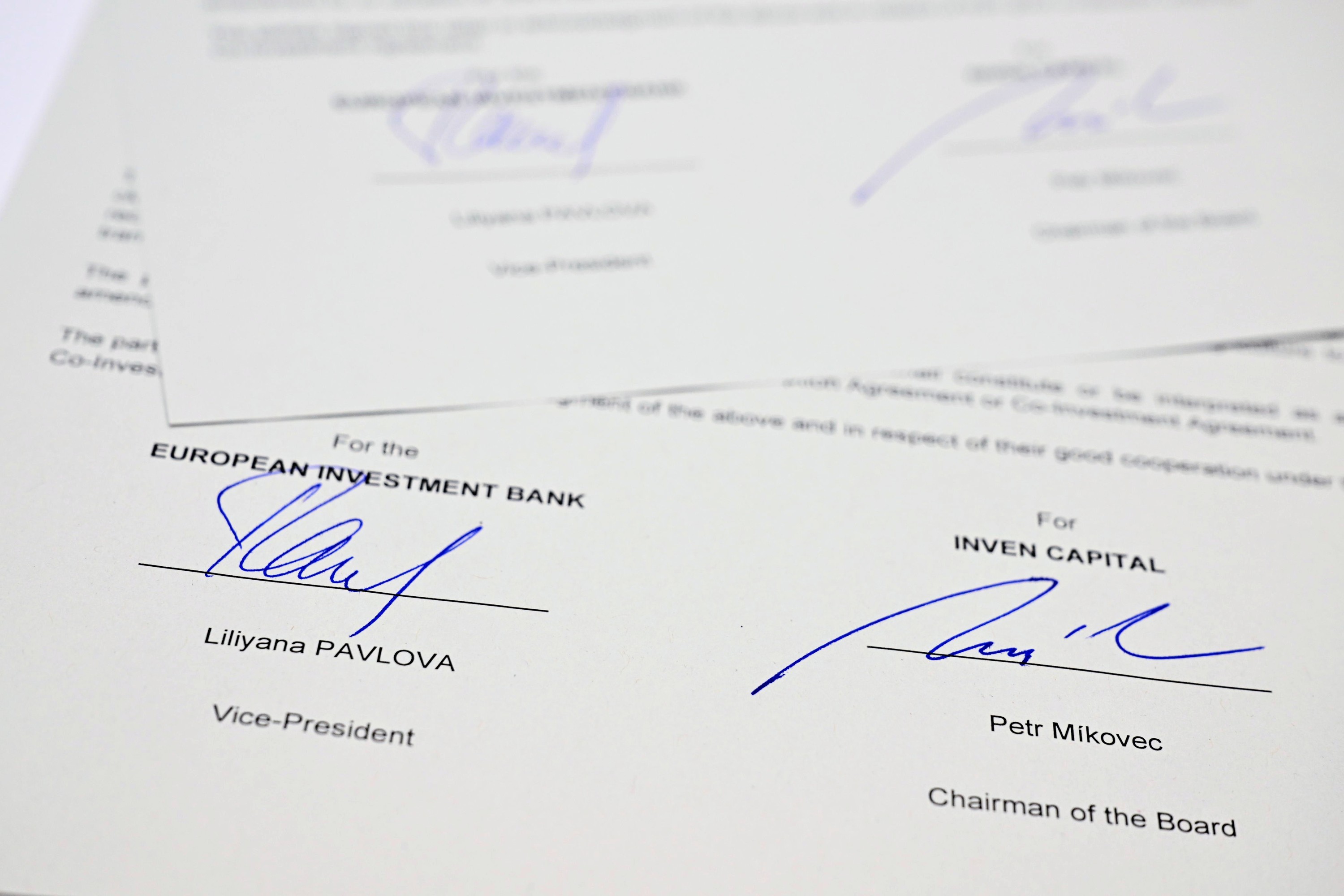

EIB and Inven Capital have doubled up on strategic partnership, with the EIB committing a further EUR 50 million to fund innovative clean-tech and decarbonisation start-ups. The EIB invested the first EUR 50 million alongside Inven over the period 2017-2022.

This renewed collaboration will deploy equity to innovative clean-tech and decarbonisation SMEs and Mid-Caps in the EU and increase the contribution of the SME/Innovation window to the EU Bank’s Climate Action & Environmental Sustainability goals. Some of Inven’s investments are also beneficial to the urgent REPower EU initiative. They help consumers reduce their energy consumption and hence their reliance on gas supplies from unstable, unreliable countries. These companies will be then developing solutions to reduce the carbon footprint and other negative externalities of a wide range of sectors from agriculture to transportation and energy generation.

Inven Capital and EIB have so far co-invested into companies that substantially contribute to greenhouse gas emission reduction in Europe. For instance, the Czech portfolio company Woltair is helping households to avoid more than 8 kt of CO2 annually thanks to the heat pumps and PV modules they have installed since Inven invested. The German company Tado° that produces smart thermostats calculates the amount of saved CO2 emissions thanks to higher energy efficiency at 730 kt since 2013.

EIB Vice-President Lilyana Pavlova said: „With their vast experience and a strong network in the clean-tech sector, Inven is an ideal partner for the EIB to swiftly deploy capital in that market crucial to the EU's energy transition. It significantly increases the fund’s resources to support the targeted innovative SMEs and adds further expertise. In this crisis it is critical that we work together with trusted partners to generate much-needed support for European businesses and turn the crisis into an opportunity to advance with cleaner, more sustainable energy generation.”

Member of the Board of Directors and Chief Renewable Energy and Distribution Officer of CEZ Tomáš Pleskač stated: “Inven Capital has gradually broadened their scope of investments and their portfolio significantly contributes to clean, sustainable, decentralized energy and to the reduction of global CO2 emissions in all areas of the economy, including transport, industry, international freight, or agriculture. We are honoured by the European Investment Bank´s trust and appreciation of the fund’s work thus far and we look forward to our continued cooperation.”

Managing Director and Chairman of the Board of Inven Capital Petr Míkovec commented: “We view this continued partnership with the EIB as a great commitment in continuing to support outstanding start-ups with positive carbon reduction impact. In line with the CEZ Group’s Vision 2030, we at Inven Capital consider sustainability as one of our core values, implementing ESG screening into our investment process and actively supporting our portfolio companies in applying sustainable best practices.”

Inven strengthens its position on the market

The Czech energy utility CEZ Group, the owner of Inven Capital, provided over EUR 210 million for the fund’s 2022-2027 investment period. Together with EIB´s input, Inven has currently more than EUR 260 million at their disposal to use for new investments. With the total fund size exceeding EUR 500 million, Inven reinforced its position as a strong and stable partner for innovative start-ups and co-investors, including major global players.

During the first investment period (2015-2022), Inven Capital has screened approx. 3 200 investment opportunities and built a diversified portfolio of 16 companies from various European countries and the State of Israel out of which five were already exited (fully or partially) with an average internal rate of return of 36% (IRR). The invested companies employ almost 2 500 people. EIB co-invested in eight of those, namely in the German companies Cloud&Heat, Tado°, Zolar and Forto, with the last mentioned becoming the first unicorn in the portfolio in 2021, the French company CosmoTech, Swedish company Eliq, and Czech companies Neuron Soundware and Woltair.

About REPowerEU

The new co-investment initiative will allow Inven Capital to continue in its mission to invest in and support the growth of clean-tech start-ups with innovations that can scale positive change and eliminate negative planetary impact, focusing mainly on the topic of decarbonization and sustainability. The cooperation also furthers the objectives of the European Commission’s REPowerEU plan aiming to save and produce clean energy and diversify our energy supplies and is backed by financial and legal means to build the new energy infrastructure that Europe needs.

REPowerEU sets out a series of measures to rapidly reduce dependence on Russian fossil fuels and fast-forward the green transition, while increasing energy system resilience EU-wide. The plan is based on finding alternative energy supplies, making behavioral changes to save energy and spurring investment in renewable energy.

Background information:

The European Investment Bank (EIB) is the long-term lending institution of the European Union owned by its Member States. It makes long-term finance available for sound investment in order to contribute to EU policy goals. The bank finances projects in four priority areas — infrastructure, innovation, climate and environment, and small and medium-sized enterprises (SMEs). In 2021 and 2022, the EIB Group provided €2.9 billion in financing to projects in the Czech Republic.

INVEN CAPITAL is CEZ Group´s venture capital fund. Their strategy is to seek out investment opportunities in innovative and fast growing cleantech startups, with focus on CO2 footprint reduction. They primarily focus on later-stage growth investment opportunities with a sound business model proven by realized revenues and long-term growth potential. The fund is a member of Invest Europe (European Private Equity and Venture Capital Association) and CVCA (Czech Private Equity and Venture Capital Association). Since 2015, INVEN CAPITAL has invested in a total of sixteen companies, and made successful full or partial exits from five of them. For more information, visit www.invencapital.cz.

- Czech Republic: EIB to finance modernisation of ČEZ's distribution grid and connection of new renewable energy sources with a record-breaking loan of €790 million

- Czech Nuclear Power Plants Comply with International Environmental Protection Standards

- Elektrárna Dukovany II, a. s., a ČEZ Group company, has received bids from three bidders for the construction of a new nuclear power source in Dukovany

- Photovoltaic technology the size of a football field going up in the centre of Prague: 2080 panels will cover 10% of the Prague Congress Centre's consumption and save CZK 5.5 million per year